It is reported that, the recent serious covid-19 spreading in provinces of Xinjiang and Inner Monogolia in China has generated a heavy impact on silicon materials supply and inland logistics, which has made the prices of solar cells and panels still stay at high levels.

In 2022, global installation capacity of solar power is about 250-260GW, including the solar power projects in China of about 70 to 80GW, accounting for about 30% of global capacity, and this part of capacity in China will be mainly installed in the fourth quarter of this year. Therefore, the rigid demand of solar panels in Q4 will further stimulate the solar panel consumption.

In addition, the demand of solar panels will also increase before Christmas holidays in EU markets and other countries. It is foreccast that recent supply shortage of solar silicon and wafers in China will intensify the prices of whole solar supply chain, including silicon, wafer, cells and solar panels.

Polysilicon

Since the 11th holiday to the present, the domestic market of silicon materials has been falling one after another, but the long orders of major domestic silicon materials manufacturers have been signed before the holiday this month, so the prices of monocrystalline dense materials of domestic mainstream manufacturers have been temporarily There is no adjustment. The re-feeding price of long single and single crystal in October is 306-308 yuan/kg, and the price of N-type material is about 2 yuan/kg higher on this basis. Currently, domestic silicon material manufacturers are basically in the schedule for production and delivery. . However, during the 11th long holiday, the new crown epidemic in Xinjiang, Inner Mongolia and other places in China intensified, and the logistics and transportation problems in the two places became increasingly serious, and some downstream shipments to the factory also experienced varying degrees of delay. For the future price trend of silicon material, the market expects that it will fall when the new production capacity of silicon material will gradually increase in the fourth quarter, but when and how much it will fall will also depend on the final game between the supply and demand sides of silicon material in the market.

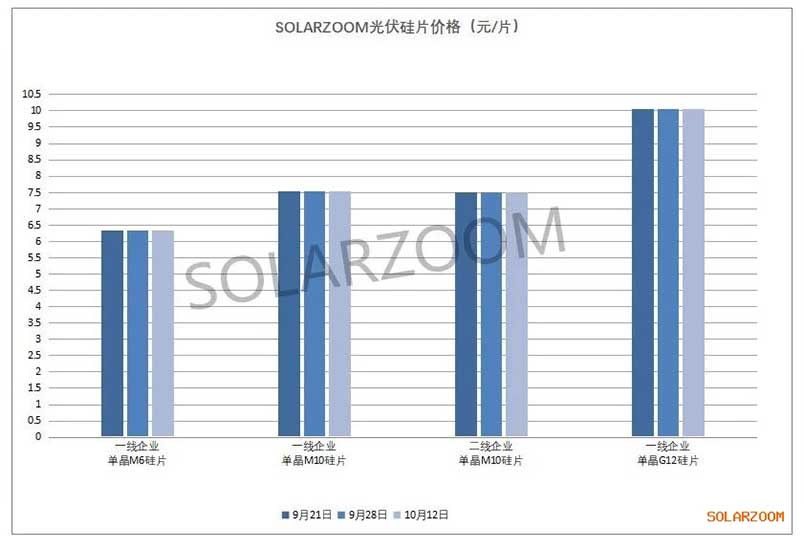

Silicon wafer

Recently, the epidemic situation in Xinjiang and Inner Mongolia has become increasingly severe. Some parks are temporarily in a state of "no entry and exit". The logistics and transportation of corresponding raw materials and silicon wafers have also been significantly affected. The price of silicon wafers also formed a certain support. This week, the quotations of domestic monocrystalline high-efficiency silicon wafers remained stable as a whole, with no significant changes. Supported by the demand for the start of domestic downstream power station projects, the domestic high-efficiency silicon wafer prices were also relatively firm. At present, the price of monocrystalline 182 high-efficiency positive A-grade silicon wafers In the range of 7.5-7.52 yuan/piece, the price of single crystal M6/G12 silicon wafers is around 6.31 yuan and 10.05 yuan/piece, but the prices of other grades and inefficient silicon wafers of various sizes are still slightly weak. Except for Inner Mongolia, the production and shipment of monocrystalline silicon wafers in other regions are relatively normal. In terms of N-type silicon wafers, N-type silicon wafers are relatively stable, and the current price of single crystal M6/M10/G12 150μm silicon wafers remains at 6.84, 8.23, and 10.66 yuan/piece.

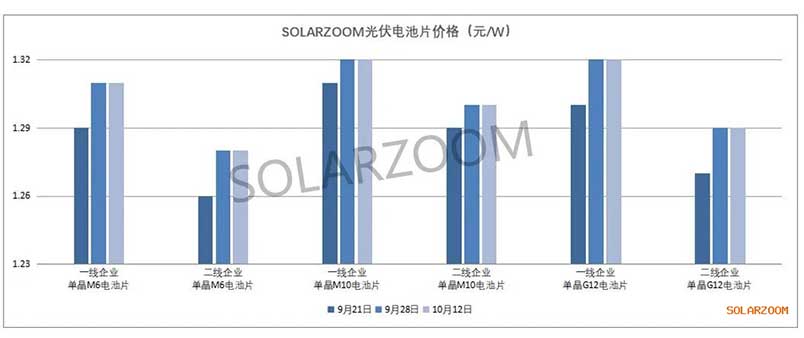

Cell

Before the National Day holiday, various domestic cell manufacturers have raised the prices of cells of various sizes in October. After the holiday, the price of monocrystalline high-efficiency cells in the domestic market continued to be high and firm. The current mainstream monocrystalline cell size 182 The transaction price of high-efficiency cells has reached 1.33- In the range of 1.34 yuan/W, a small number of transactions in the market have seen a high price of 1.35 yuan/W. The overall enthusiasm for purchasing is driven by downstream demand. At the same time, the demand for domestic batteries in overseas markets is also relatively strong; the price of monocrystalline G12 batteries has come In the 1.3-1.33 yuan W range, large-size high-efficiency batteries are still in short supply despite the gradual reduction of export sales by leading domestic battery companies, but the demand for mono-crystalline M6 batteries and low-efficiency batteries in other size batteries is relatively general in the market. In terms of N-type batteries, as the price of P-type batteries continues to rise, the price of N-type batteries in the market is also rising. The overall mainstream price of N-type batteries falls in the range of 1.4-1.45 yuan/W.

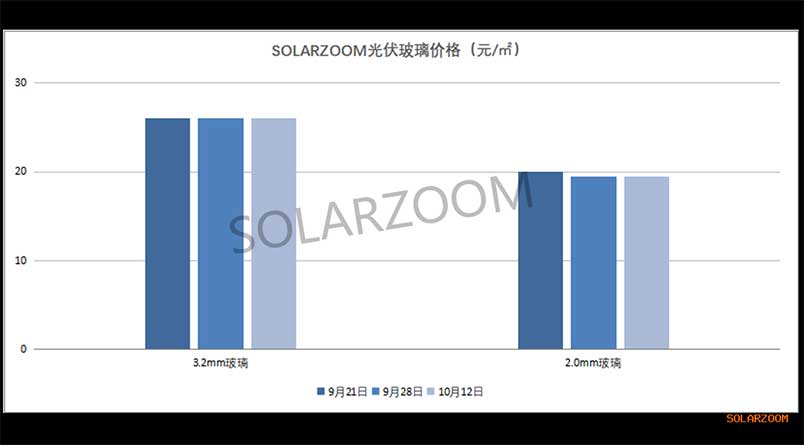

Auxiliary material

In terms of auxiliary materials, the domestic auxiliary material market is basically stable after the festival. The price of 3.2mm glass is stable at 25.5-26 yuan/㎡, and the price of 2.0mm is in the range of 19-19.5 yuan/㎡; the price of welding strips has increased slightly. The price of the welding strip is about 86 and 91 yuan/㎡.